When it comes to choosing life insurance, there are a variety of policies available that cater to different financial goals. One of the most versatile options is Universal Life Insurance (UL). This type of insurance not only provides lifelong coverage but also offers flexibility in premium payments and the potential for cash value accumulation. In this blog, we’ll explore what universal life insurance is, its key features, and why it might be the right choice for your financial plan.

What is Universal Life Insurance?

Universal life insurance is a type of permanent life insurance, which means it provides coverage for the entirety of your life, as long as the policy remains active. Unlike term life insurance, which only covers a set period (e.g., 10 or 20 years), universal life insurance offers continuous protection, along with the opportunity to build cash value over time.

The flexibility that universal life insurance offers is one of its standout features. Policyholders can adjust their premium payments and death benefits according to their changing financial situations, making it a great choice for those looking for more control over their life insurance policy.

Key Features of Universal Life Insurance

Universal life insurance is attractive because of its adaptability and potential for financial growth. Here are some of its most important features:

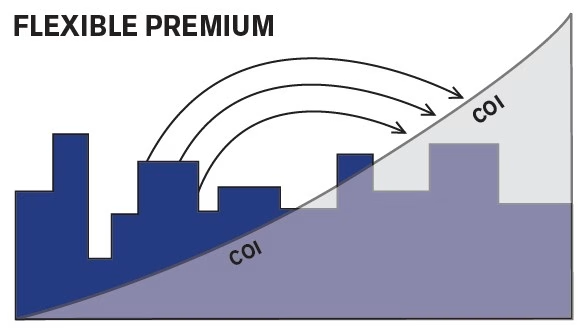

- Flexible Premiums

One of the main draws of universal life insurance is its flexible premium structure. You have the option to pay higher premiums in the early years to accumulate cash value or reduce your payments later on if your financial situation changes. This flexibility allows you to tailor the policy to your needs over time. - Cash Value Growth

A portion of your premiums goes toward building a cash value within the policy. The cash value can grow over time, usually at a rate determined by the insurer or tied to an interest rate. This can serve as a savings component within the policy, offering tax-deferred growth, which means you won’t pay taxes on the gains as they accumulate. - Adjustable Death Benefit

Universal life insurance allows you to adjust the death benefit (the payout your beneficiaries receive) to match your changing needs. You might choose to increase the death benefit if your financial obligations grow, or decrease it if you’ve paid off significant debts like a mortgage. - Policy Loans and Withdrawals

As the cash value in your policy grows, you can access it through policy loans or withdrawals. These funds can be used for a variety of purposes, such as supplementing retirement income, covering unexpected expenses, or funding a child’s education. However, withdrawals may reduce the death benefit. - Tax Advantages

The cash value in a universal life insurance policy grows tax-deferred, meaning you don’t pay taxes on it as it accumulates. Additionally, the death benefit is usually paid out to beneficiaries tax-free, making universal life insurance a powerful tool for estate planning.

Types of Universal Life Insurance

Universal life insurance policies come in several forms, each with its own approach to cash value accumulation:

- Guaranteed Universal Life Insurance (GUL)

GUL policies focus more on providing lifelong coverage than on building cash value. The premiums are fixed, and the policy guarantees a death benefit as long as the premiums are paid. - Indexed Universal Life Insurance (IUL)

IUL policies tie the growth of the cash value to a stock market index, like the S&P 500. This allows for greater potential growth, but with some risk tied to market fluctuations. Many IUL policies have a cap on gains and a floor to protect against market losses. - Variable Universal Life Insurance (VUL)

With VUL, you have the opportunity to invest your policy’s cash value in a range of investment options, similar to mutual funds. While this offers the potential for significant growth, it also comes with the risk of losing value if the investments underperform.

Is Universal Life Insurance Right for You?

Universal life insurance can be an excellent choice if you’re looking for a policy that offers long-term coverage, flexibility, and the potential for cash accumulation. Here are a few situations where UL might be a good fit:

- Need for Flexibility: If you anticipate changes in your financial circumstances, such as fluctuating income, universal life insurance provides the flexibility to adjust premiums and death benefits accordingly.

- Estate Planning: UL is a great tool for individuals looking to leave a tax-free inheritance or provide for beneficiaries after their passing.

- Supplementing Retirement: The cash value growth and policy loans available through UL can serve as a tax-advantaged way to supplement your retirement savings, offering financial security later in life.

The Bottom Line

Universal life insurance is a versatile and flexible insurance product that can provide both lifelong protection and an opportunity for tax-deferred savings. Whether you’re planning for your family’s financial future, looking for ways to supplement your retirement income, or want to leave a legacy for your loved ones, UL offers a customizable solution to meet your long-term financial goals.

Universal life insurance can serve as a Life Insurance Retirement Plan (LIRP) by allowing policyholders to accumulate tax-deferred cash value over time, which can be accessed in retirement to supplement income without the same tax implications as traditional retirement accounts.

To strengthen your overall financial strategy, it’s important to see universal life insurance as part of a larger framework that includes the 4 Pillars of Financial Planning: Protection, Debt Management, Emergency Fund, and Investment, each contributing to long-term financial security If you’re interested in learning more about how universal life insurance can fit into your financial strategy, contact us today. We’ll help you explore the options and choose the best policy for your unique needs.