Are you looking for a tax-efficient way to build wealth while ensuring financial protection for your family? A Life Insurance Retirement Plan (LIRP) could be the ideal solution. In this blog, we’ll break down what an LIRP is, its unique tax advantages, and why it could be a valuable part of your financial strategy.

What is a Life Insurance Retirement Plan (LIRP)?

A Life Insurance Retirement Plan (LIRP) is a financial tool that offers a dual purpose—building wealth for retirement while providing life insurance protection. It’s treated differently from other investment accounts due to its tax advantages, making it a smart option for those who want flexibility and tax-free income in retirement.

How Does an LIRP Work?

An LIRP works by allowing you to contribute money into a “bucket,” which grows over time. The beauty of this bucket is that it falls under a different section of the IRS tax code, offering a variety of benefits traditional government-sponsored retirement plans like IRAs or 401(k)s don’t provide.

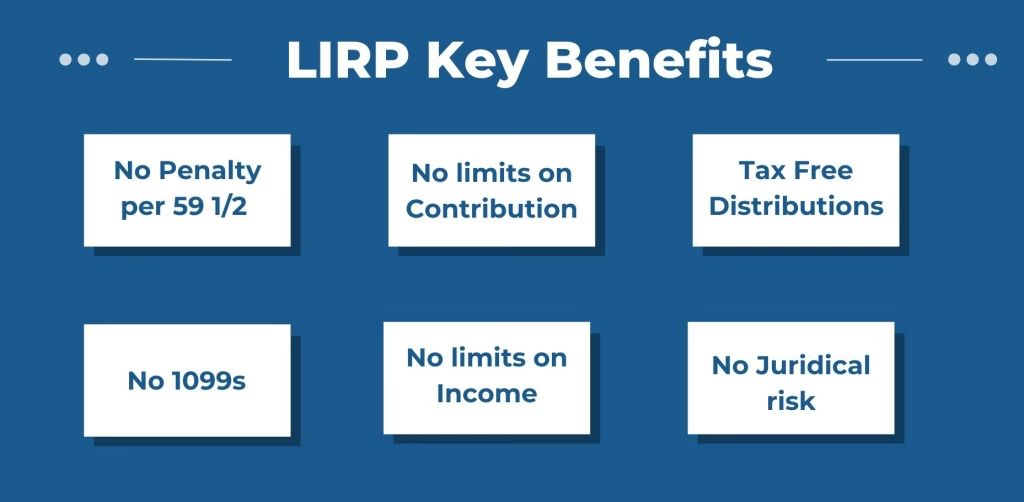

- No Penalty Before 59½: Unlike traditional retirement accounts such as 401(k)s or IRAs, LIRPs allow you to access your funds before the age of 59½ without incurring a penalty.

- No 1099s: As your money grows within the LIRP, you don’t receive a 1099 form, meaning you don’t have to pay taxes on the gains during the accumulation phase.

- Tax-Free Withdrawals: If managed properly, LIRP withdrawals can be tax-free, which is a huge advantage, particularly when it comes to keeping your Social Security from being taxed.

No Contribution or Income Limits

One of the most appealing aspects of an LIRP is the lack of contribution and income limits. For example, Roth IRAs have strict contribution limits based on income, meaning that high earners can’t contribute. With an LIRP, there are no such restrictions—whether you’re earning a modest income or a substantial one, you can take full advantage of its benefits.

No Legislative Risk

History shows that LIRPs are protected from legislative changes. There have been several rule changes in the past (1982, 1984, 1988), but each time, existing account holders were grandfathered into the old rules. This offers a sense of security that even in an uncertain legislative environment, your LIRP won’t be affected.

Death Benefit & Long-Term Care

What makes an LIRP even more attractive is its flexibility in providing both a death benefit and long-term care. If you ever need long-term care, your LIRP allows you to access a portion of your death benefit while you’re still alive. For example, if you have a $500,000 death benefit and require long-term care, your LIRP could provide $120,000 per year over five years to cover those expenses.

Additionally, if you never end up needing long-term care, your death benefit will still be passed on to your beneficiaries, ensuring that your money doesn’t go to waste.

The Cost of LIRPs: What You Need to Know

No financial tool is perfect, and LIRPs come with costs—primarily in the form of life insurance premiums. However, the upside is that this cost of admission also brings substantial tax-free growth and financial flexibility. The life insurance portion may not seem as relevant if you’re approaching retirement and don’t have significant financial dependents, but the long-term care benefit can make this an invaluable safety net.

The Bottom Line

An LIRP offers a powerful combination of tax benefits, financial flexibility, and protection. If you’re looking for a way to build wealth while also safeguarding your family’s future, this could be a perfect fit. If you’d like personalized guidance on whether an LIRP is the right choice for you, feel free to reach out for a complimentary strategy session. By incorporating LIRPs into your broader financial strategy, you’re setting yourself up for a more secure and tax-efficient retirement. Want to learn more? Schedule a strategy session today!