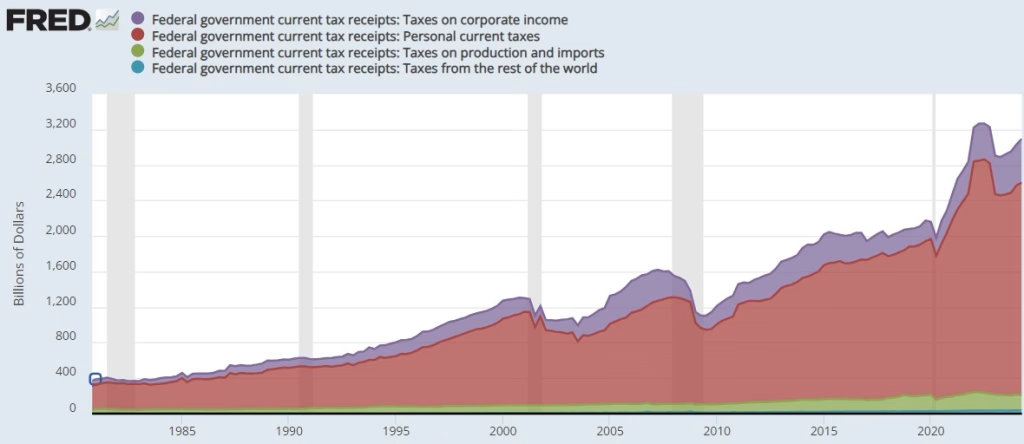

As we navigate a future full of economic uncertainty, one of the smartest economic voices has sounded the alarm: David Walker, former CPA of the USA, predicted that tax rates for middle-income Americans would need to double by 2030 if the U.S. wants to avoid going broke. Walker, who wrote Comeback America, uncovered that the federal government has promised far more than it can afford to deliver—especially when it comes to Medicare, Medicaid, and Social Security.

To understand why, let’s break down the key threats to your financial future and, more importantly, how you can protect yourself by building wealth in Roth IRAs, Roth 401(k)s, and cash value life insurance to reach the 0% tax bracket.

Why the 0% Tax Bracket is Crucial

The idea is simple: If tax rates double in the future, 2 times 0 is still 0. That’s why getting to a 0% tax bracket is such a critical goal for anyone worried about rising taxes. This can be achieved by contributing to tax-advantaged vehicles like Roth IRAs, Roth 401(k)s, and cash value life insurance—where you pay taxes on the money you contribute upfront, but your withdrawals in retirement can be tax-free.

So, how did we get here? There are four main forces at play, commonly referred to as the four “D”s:

1. Deficits: A Growing National Problem

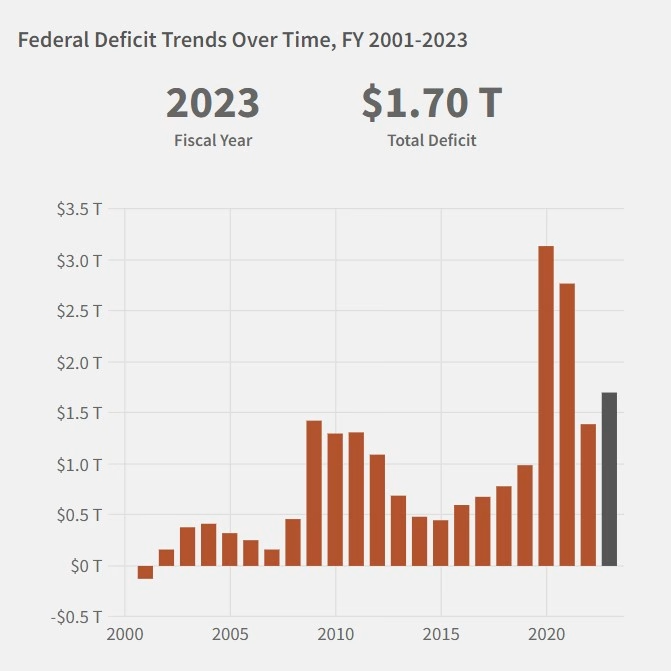

Back in 2000, the U.S. had a $236 billion surplus. This was a genuine surplus, excluding Social Security funds. Fast forward to recent years, and the story has dramatically changed. In 2022, the U.S. posted a deficit of $1.42 trillion. This year, the deficit is projected to hit $1.5 to $1.6 trillion. What happened?

Several factors contributed to this surge in deficits, including the recession, two undeclared wars, and bailouts for insurance companies, financial institutions, and automobile manufacturers. While deficits are sometimes necessary in the short term, they set the stage for increasing debt, which brings us to the next “D.”

2. Debt: Doubling in a Decade

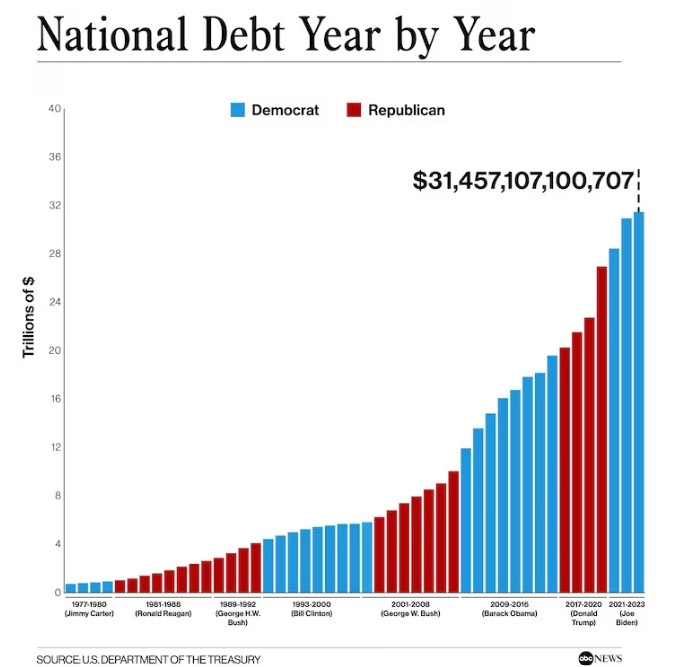

Over the past 10 years, the national debt has doubled and is on track to double again within the next decade. Historically, the U.S. only ran deficits during declared wars, severe recessions, or depressions, but now we accumulate debt without a clear reason.

After World War II, debt-to-GDP was at 122%, the highest in history, but we had something to show for it. We saved the free world, and our economy boomed, accounting for over 50% of global GDP. Today, the U.S. debt-to-GDP ratio is about 85%, headed toward 95%. Yet, we aren’t seeing similar benefits.

To make matters worse, about half of our public debt is now held by foreign lenders, meaning the interest on that debt goes overseas, negatively impacting our national security and economic stability.

3. Dependency: Relying on Foreign Lenders and Government Promises

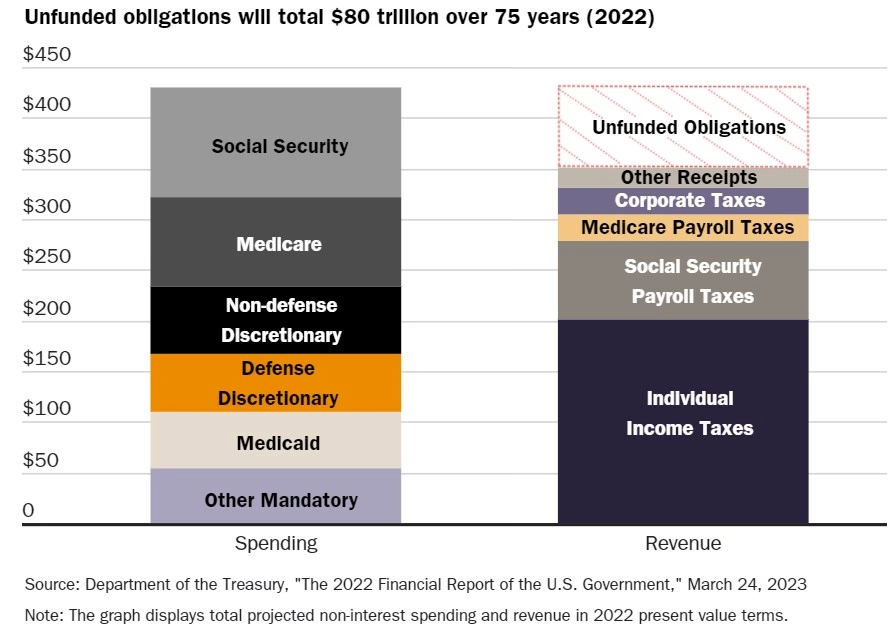

Another serious issue is dependency—not just on foreign lenders, but also on government promises. The U.S. is grappling with $50 trillion in unfunded obligations. These include Social Security, Medicare, and other commitments that don’t yet represent formal debt but will in the future.

For instance, Medicare alone has a $38 trillion shortfall, while Social Security faces a $7 trillion gap. These are massive numbers, and unless reforms happen soon, they will become a heavy burden on future taxpayers—especially the middle class.

4. The Ditch: Off-Balance-Sheet Obligations

Our biggest problem isn’t today’s deficit or even today’s debt—it’s the unfunded promises and obligations that don’t appear on the balance sheet yet. The U.S. has $12.5 trillion in official debt and about $50 trillion in off-balance-sheet obligations, mainly for Medicare and Social Security.

Without meaningful reforms, these off-balance-sheet obligations will turn into real debt tomorrow, making it even harder for future generations to thrive.

How to Protect Yourself: Roth IRAs, Roth 401(k)s, and Life Insurance

So, how do you safeguard your wealth from skyrocketing taxes? Here’s what you can do:

- Contribute to a Roth IRA: A Roth IRA allows you to pay taxes on your contributions now, but the growth and withdrawals in retirement are tax-free. If tax rates double, you’ll be glad to have tax-free income.

- Max Out a Roth 401(k): Similar to a Roth IRA, a Roth 401(k) gives you the benefit of tax-free withdrawals in retirement, helping you maintain a 0% tax bracket even in a high-tax environment.

- Leverage Life Insurance Retirement Plan (LIRP): Policies like whole life insurance or universal life insurance can provide tax-free loans and withdrawals from the cash value component of the policy, offering another avenue of tax-free income.

Final Thoughts

The economic challenges ahead, from rising deficits and debt to increasing dependency on government programs, suggest that tax rates will likely rise in the future. But by making smart financial decisions today—like building wealth in Roth IRAs, Roth 401(k)s, and cash value life insurance—you can shield yourself from the impact of those future tax hikes.

As a financial consultant in Los Angeles and Orange County, I specialize in helping clients navigate complex tax and financial strategies to build sustainable wealth. If you want to learn more about how to protect your wealth and plan for a 0% tax future, let’s talk.