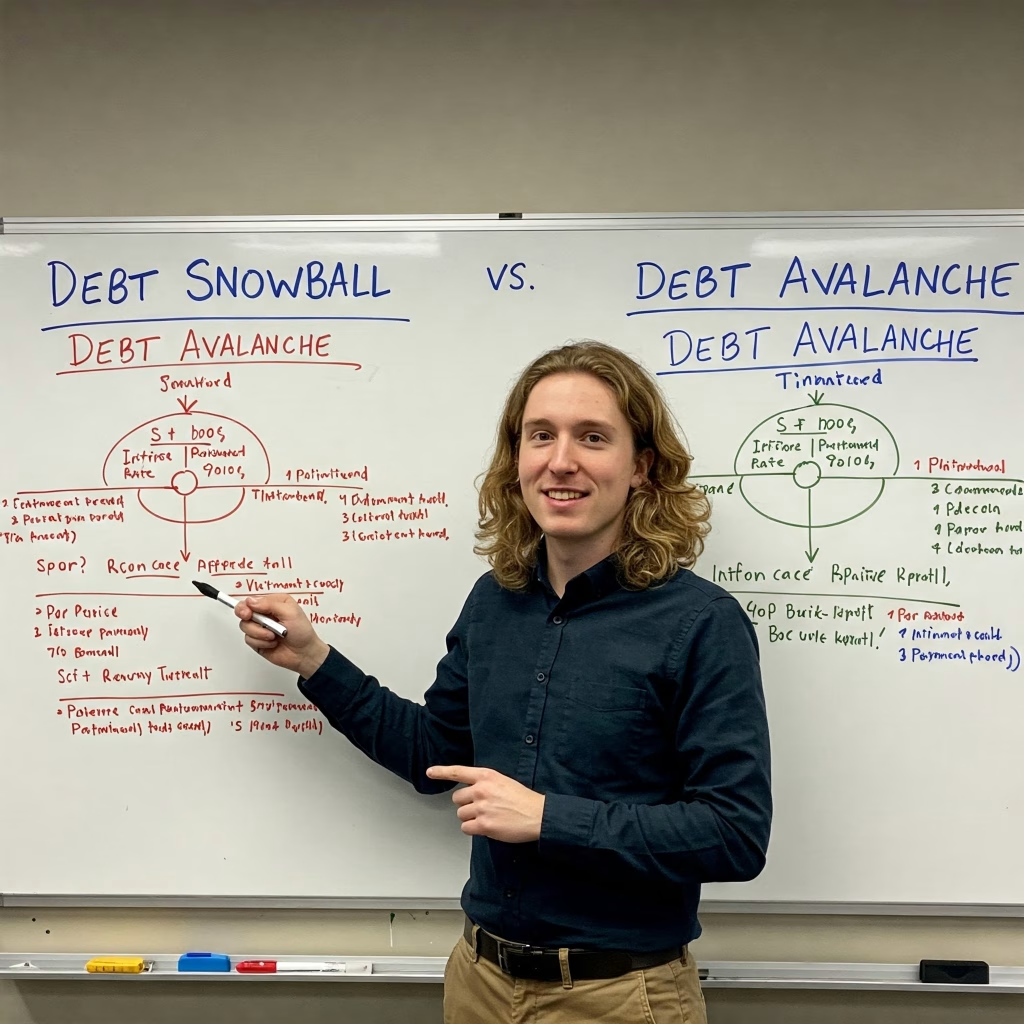

Struggling with debt can feel overwhelming, but choosing the right repayment strategy can make all the difference. Two popular methods—Debt Snowball and Debt Avalanche—offer distinct approaches to tackling debt. But which one is best for you? In this guide, we’ll break down the differences, benefits, and drawbacks of each strategy to help you decide. Let’s dive in!

What is the Debt Snowball Method?

The Debt Snowball method, popularized by financial expert Dave Ramsey, focuses on paying off your smallest debts first. Here’s how it works:

- List all your debts from smallest to largest balance.

- Make minimum payments on all debts except the smallest one.

- Throw as much extra money as possible toward the smallest debt until it’s paid off.

- Once the smallest debt is gone, roll that payment into the next smallest debt, creating a “snowball” effect.

Why It Works: The Debt Snowball is all about momentum. Paying off smaller debts quickly gives you a psychological boost, keeping you motivated to stay on track.

Best For: People who need quick wins to stay committed to their debt repayment journey.

What is the Debt Avalanche Method?

The Debt Avalanche method takes a more mathematical approach by targeting high-interest debts first. Here’s the process:

- List your debts from highest to lowest interest rate.

- Make minimum payments on all debts except the one with the highest interest rate.

- Put extra funds toward the highest-interest debt until it’s eliminated.

- Move to the next highest-interest debt, letting the savings “avalanche” down.

Why It Works: By focusing on high-interest debts, you minimize the total interest paid over time, making it the most cost-effective strategy.

Best For: Analytical individuals who prioritize saving money and don’t mind a slower start to see results.

Debt Snowball vs. Debt Avalanche: Key Differences

| Factor | Debt Snowball | Debt Avalanche |

| Focus | Smallest balance first | Highest interest rate first |

| Speed of Wins | Faster initial payoffs | Slower initial progress |

| Cost Efficiency | May pay more interest overall | Minimizes total interest paid |

| Motivation Style | Emotional wins | Logical savings |

Pros and Cons of the Debt Snowball Method

Pros:

- Quick wins boost morale and motivation.

- Simplifies your debt list faster.

- Great for those with multiple small debts.

Cons:

- You might pay more interest in the long run.

- Less efficient for high-interest debts.

Example: If you have a $500 credit card balance at 15% interest and a $5,000 loan at 10%, you’d tackle the $500 first, even though the loan’s interest rate is eating into your savings more.

Pros and Cons of the Debt Avalanche Method

Pros:

- Saves the most money on interest.

- Ideal for large, high-interest debts like credit cards.

- Faster overall debt payoff in terms of total cost.

Cons:

- Slower to see progress, which can feel discouraging.

- Requires discipline to stick with it.

Example: With a $10,000 credit card at 20% interest and a $2,000 loan at 5%, you’d attack the credit card first, saving significant interest over time.

Which Debt Repayment Strategy Should You Choose?

The right choice depends on your personality, financial goals, and debt situation. Ask yourself:

- Are you motivated by quick results? If yes, the Debt Snowball might be your best bet. Seeing debts disappear can keep you energized.

- Do you prioritize saving money? If so, the Debt Avalanche is likely the smarter move, especially if you have high-interest debts.

- What’s your debt load like? If you’re juggling several small balances, Snowball could simplify things. For fewer, high-rate debts, Avalanche shines.

Pro Tip: Use a debt payoff calculator (available online) to compare how each method impacts your timeline and total interest paid.

Can You Combine Both Strategies?

Yes! Some people blend the two approaches—starting with a small debt for a quick win (Snowball style), then switching to high-interest debts (Avalanche style). This hybrid method balances motivation and savings.

Final Thoughts: Start Today!

Whether you choose the Debt Snowball or Debt Avalanche, the key is to start now. Both strategies work if you stick to them. Assess your finances, pick the method that fits your mindset, and take control of your debt today. Ready to be debt-free? Your journey starts with one decision.

Have questions? Contact us, we’d love to hear from you!