How do you picture your retirement? Maybe it’s a time to explore new passions, reconnect with loved ones, or travel the world. But to make those dreams come true, you need one essential thing: financial security. A stable income in retirement means peace of mind. And that’s where annuities come in—turning your retirement dreams into reality by offering guaranteed income and stability.

In uncertain times, annuities can be a game changer. They’re one of the few financial products that come with guarantees. An annuity is essentially an insurance product that provides you with steady income in retirement. Unlike market-dependent investments, annuities offer protection against market volatility. Whether stocks are up or down, your income remains stable.

This financial certainty is especially valuable as you approach retirement. You’ve worked hard to build your savings, and annuities ensure your money will be there for you, even when markets are unpredictable. Imagine planning your retirement knowing your income won’t disappear during a downturn—annuities provide that peace of mind.

Different Types of Annuities for Your Unique Goals

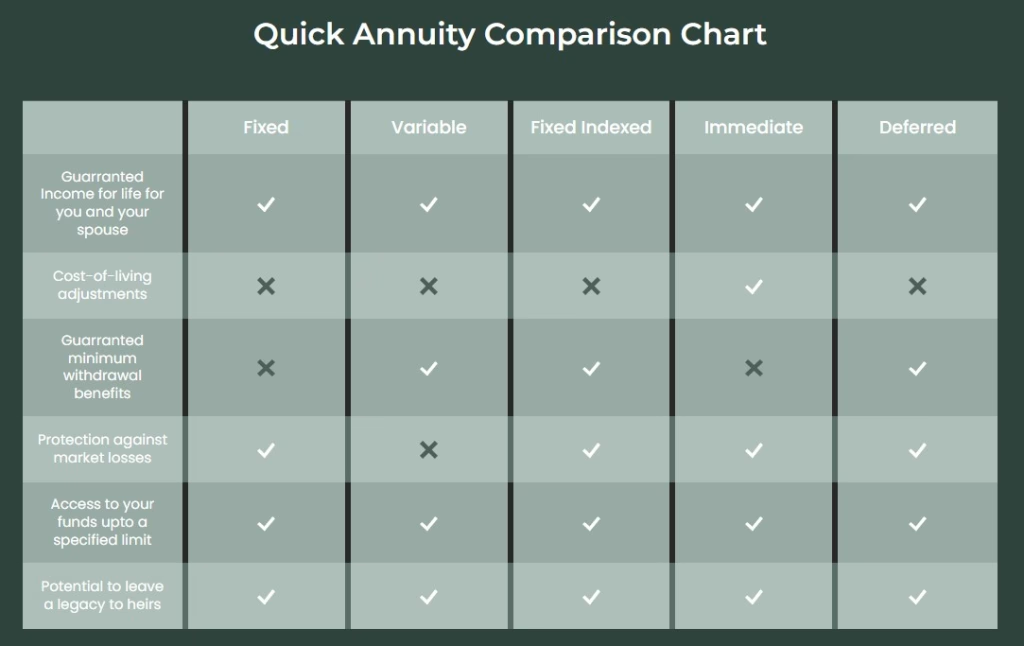

Annuities come in various forms, each designed to meet specific retirement needs. Let’s break down the key types:

- Fixed Annuities: These offer guaranteed payouts. If you’re looking for consistent, reliable income that isn’t tied to market performance, this is a great option.

- Variable Annuities: If you’re open to some risk, variable annuities allow you to invest in portfolios, like stocks and bonds, with the potential for higher returns.

- Indexed Annuities: These are tied to a stock market index, such as the S&P 500. They offer growth potential while also protecting against significant losses when markets drop.

Choosing the right type of annuity can feel overwhelming, but that’s where we come in. We help guide you toward the option that fits your goals and risk tolerance.

A Tailored Approach to Retirement Planning

We believe that no two retirements are the same, so why should your retirement strategy be? We take a personalized approach to retirement planning, building a plan around you—your dreams, your financial situation, and your needs.

Whether your dream is to travel the world or spend more time with loved ones, your retirement plan should give you the freedom to do so without financial worry. Our role is to make sure that the income from your annuities aligns with your unique retirement vision.

Why Include Annuities in Your Retirement Portfolio?

One of the biggest advantages of annuities is how they balance your retirement portfolio. While stocks and bonds may offer growth potential, they also come with higher risk. Annuities, on the other hand, provide that crucial, predictable income that can cushion against any downturns in the market.

Imagine a retirement portfolio where some investments grow while others, like annuities, provide guaranteed income. This mix lets you enjoy the growth potential of riskier investments while relying on the stability of an annuity to ensure that your essential needs are covered.

Annuities can also complement your other retirement savings accounts, such as IRAs or 401(k)s, by providing an additional source of guaranteed income. Many financial advisors recommend incorporating annuities to prevent the risk of outliving your savings.

Making Your Retirement Dreams Come True

Our goal is simple: we want to help you build the retirement you’ve always envisioned. Through a combination of retirement annuities and personalized financial strategies, we work with you to create a plan that is both secure and aligned with your dreams.

Retirement planning isn’t just about having money—it’s about having peace of mind. It’s about knowing you can live your retirement without the fear of running out of funds. Whether you’re close to retirement or still years away, it’s never too early or too late to start securing your future income.

To strengthen your overall financial strategy, it’s important to see Annuity as part of a larger framework that includes the 4 Pillars of Financial Planning: Protection, Debt Management, Emergency Fund, and Investment, each contributing to long-term financial security

Final Thoughts

Annuities are more than just a financial product—they’re a tool to help you live the retirement you’ve always imagined. They protect against market volatility, offer guaranteed income, and ensure your future is as secure as possible. We’re here to guide you through every step of the process, ensuring that your retirement is everything you’ve dreamed of.

If you’re ready to explore how annuities can fit into your retirement plan, reach out for a complimentary consultation today. Together, we’ll create a secure and resilient retirement strategy tailored specifically for you. Ready to explore how annuities can fit into your retirement plan? As a financial consultant serving Los Angeles and Orange County, I specialize in helping clients develop strategies that secure and resilient retirement portfolio, tailored to your dreams. Contact us today for a complimentary consultation. Together, we’ll build a more secure and resilient retirement portfolio, tailored to your dreams.