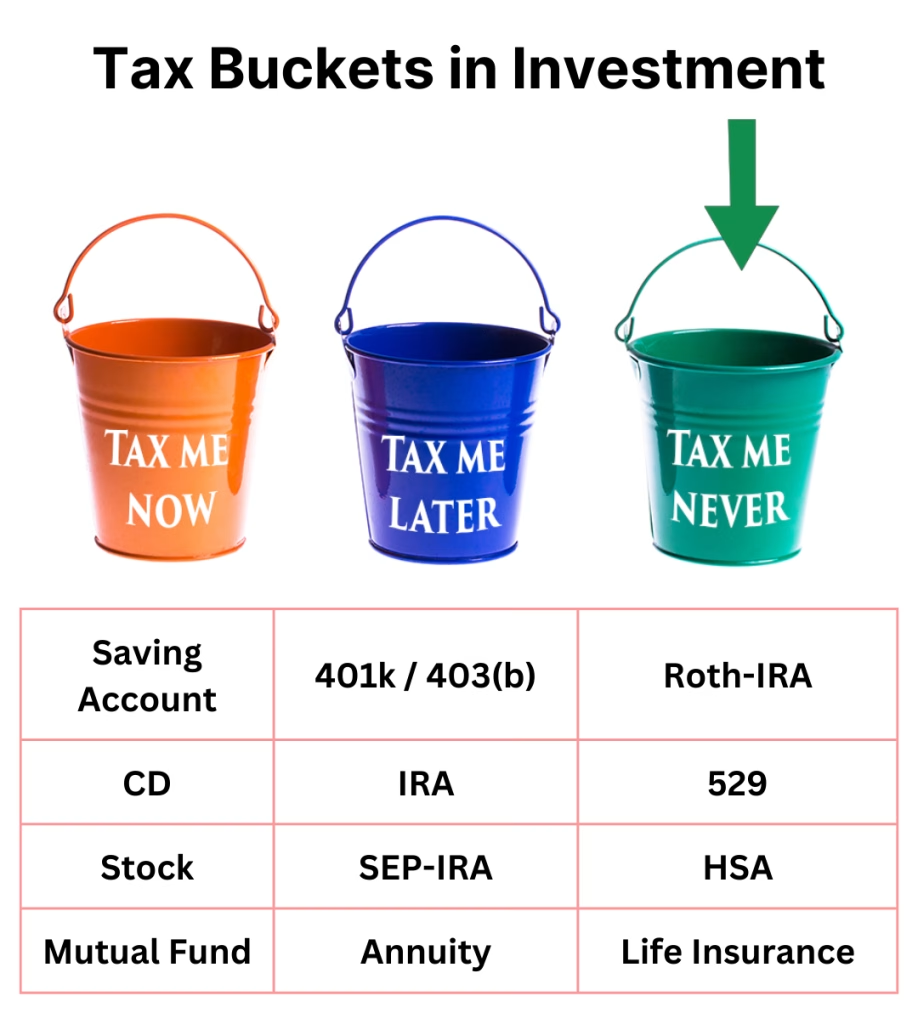

When planning your financial future, understanding how different types of investment accounts are taxed is crucial. As a financial consultant serving clients in Los Angeles, Orange County, and throughout California, I often help individuals and families navigate the complexities of taxation on their investments. In this blog, we’ll explore three key categories of tax treatment: Tax Now, Tax Later, and Tax-Advantaged

Tax Now: Pay Taxes on Earnings Immediately

When it comes to tax now accounts, any earnings from these investments are taxed in the year they are earned. If you have investments or savings in a savings account, Certificates of Deposit (CDs), or even receive dividends from stocks or mutual funds, you’re required to report this income and pay taxes on it for that tax year.

For example, let’s say you earn interest on a money market fund or have profits from Guaranteed Investment Certificates (GICs) or term deposits. These earnings are all taxable in the year they are earned. If your investments aren’t part of a tax-advantaged or tax-deferred plan, like a non-registered investment plan, your earnings fall into this tax now category. It’s important to account for these taxes as part of your overall financial management strategy.

Tax Later: Deferred Taxation for Pre-Tax Investments

Tax later accounts, also known as tax-deferred accounts, are designed to let your investments grow without having to pay taxes upfront. This means the money you contribute to these accounts is pre-tax—meaning you haven’t paid any income tax on it yet—but you will be taxed later when you withdraw the funds.

Common tax-deferred accounts in the U.S. include:

- IRA (Individual Retirement Accounts)

- SEP-IRA

- 401(k) or 403(b)

- Annuities

- Long Term Care benefits

For example, contributions to a 401(k) are made with pre-tax income, allowing you to defer taxes until you withdraw funds in retirement. The IRS allows withdrawals after age 59½, at which point withdrawals are taxed as ordinary income. Withdrawals made before age 59½, however, typically incur a 10% penalty in addition to the taxes owed. Also, once you turn 70½, you’re required to start taking required minimum distributions (RMDs) from these accounts.

While tax-deferred accounts can help you lower your taxable income now, they do come with a future tax liability. As a retirement financial planner, I help clients determine the best strategies for minimizing taxes on withdrawals and managing their retirement investments.

Tax-Advantaged: Keep More of Your Money

Tax-advantaged accounts are powerful tools for building long-term wealth while minimizing the tax impact. These accounts allow you to withdraw funds without having to pay taxes on the growth or earnings. The money you contribute to these accounts is typically after-tax, meaning you’ve already paid taxes on it, but the advantage is that withdrawals are tax-free.

Some popular tax-advantaged accounts include:

- Roth IRAs

- 529 College Savings Plans

- Health Savings Accounts (HSAs)

- Life Insurance Retirement Plan (LIRP)

For example, with a Roth IRA, the contributions you make are after-tax, but when you reach retirement age, you can take out your money without owing any taxes on the growth or earnings. Similarly, a 529 College Savings Plan allows for tax-free withdrawals when the funds are used for qualified education expenses.

Additionally, life insurance policies, such as whole life insurance, can offer tax-advantaged features. Many policies allow for tax-exempt distributions through cash value loans or withdrawals, providing you with a tax-free source of income later in life. Working with a financial consultant can help you identify the best tax-advantaged options to optimize your wealth-building strategy.

Which Tax Strategy Is Right for You?

Deciding between tax now, tax later, and tax-advantaged accounts depends on your current financial situation, future goals, and overall tax strategy. A diversified approach often works best, balancing your immediate tax needs with long-term wealth growth.

As a financial planner specializing in investment planning and wealth management, I work with clients across Los Angeles, Orange County, and California to create customized strategies. From contributing to IRAs, 401(k)s, and Roth IRAs, to exploring life insurance options, I’m here to help you navigate the complexities of tax-efficient investing.

Final Thoughts

Understanding the tax implications of your investment accounts is key to building a strong financial foundation. Whether you’re investing in tax now accounts like savings and CDs, tax later options like 401(k)s and IRAs, or tax-advantaged vehicles like Roth IRAs and 529 plans, making informed decisions will help you minimize tax liability and maximize growth.

If you’re looking for expert advice on tax planning, retirement accounts, or investment strategies, contact me today. I’ll work with you to develop a tax-efficient plan tailored to your unique needs and goals, ensuring that your hard-earned money works for you now and in the future.