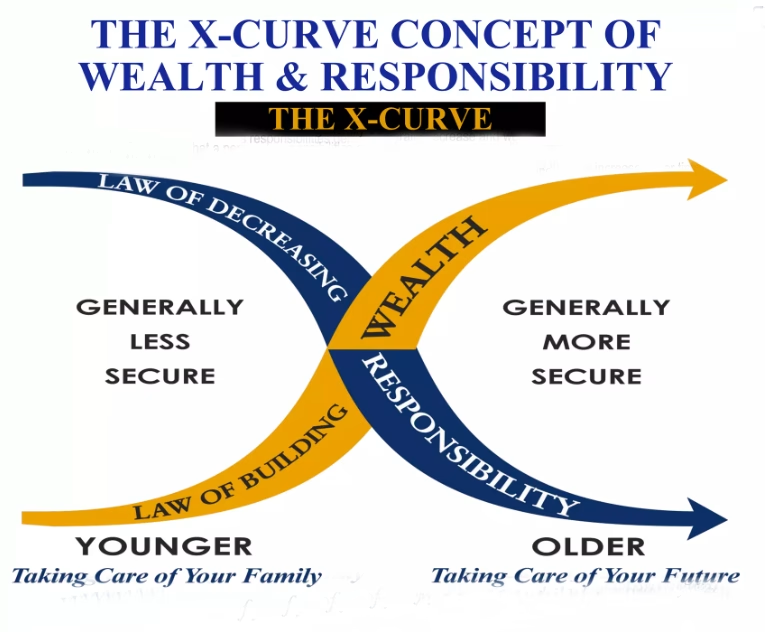

As a financial consultant serving clients in Los Angeles, Orange County, and throughout California, I often use the X-Curve Concept to explain the relationship between financial responsibility and wealth-building over time. This simple yet powerful concept helps visualize how a person’s financial responsibilities decrease while their wealth grows, especially with proper financial planning.

Whether you’re managing retirement accounts like a 401(k), Roth IRA, or Traditional IRA, or navigating the complex world of life insurance, understanding the X-Curve is essential for anyone serious about building long-term financial security.

The Wealth Curve: Building Your Financial Future

At the beginning of your financial journey, it’s common to have little to no savings. But as you progress, you start saving and investing. Over time, your wealth grows, symbolized by the rising Wealth Curve.

This curve represents your investment growth—from early retirement accounts like Roth IRAs or SEP IRAs, to more comprehensive investment strategies designed to maximize your wealth as you approach retirement. The goal is to have enough wealth to support your lifestyle when you retire, making retirement planning a crucial part of your financial future.

The Responsibility Curve: Managing Financial Obligations

On the other side of the X-Curve is the Responsibility Curve. Early in life, when you’re just starting a family or purchasing a home, your responsibilities are at their peak. These responsibilities often include:

- Children and their future education (think college or university savings)

- Mortgage payments

- Debt obligations

- General family expenses

During this time, your need for insurance protection is high. Should something unexpected happen, such as a loss of income or worse, your family could be left with significant financial burdens. This is where life insurance becomes critical.

As you grow older, the Responsibility Curve naturally declines. Your mortgage may be paid off, your children become financially independent, and you reduce your debts. At this stage, the need for life insurance typically decreases, but your focus shifts toward wealth management and estate planning.

Balancing the X-Curve: A Comprehensive Approach to Financial Planning

Understanding how the X-Curve works is key to achieving financial stability. Early in life, your responsibility is high, and your wealth is low. However, as you progress through life, your responsibility curve declines, and your wealth curve rises.

To ensure this balance is maintained, proper financial planning is essential. Whether you’re saving for retirement with a Roth 401(k) or traditional IRA, or planning your future with life insurance or an annuity, each element plays a role in managing your finances. It’s about making smart choices in money management and investment planning to ensure both your present and future are secure.

Why Work with a Financial Consultant?

Navigating the ups and downs of the X-Curve is easier with professional guidance. As a retirement financial planner, I specialize in helping clients maximize their retirement investments and prepare for the future. Whether you’re based in Los Angeles, Orange County, or elsewhere in California, my goal is to help you achieve financial peace of mind.

With a focus on financial management, I offer tailored advice on everything from investment strategies to estate planning, helping you grow your wealth while managing your responsibilities. By understanding your unique situation, I can craft a plan that ensures your wealth rises as your responsibilities decrease.

A well-rounded financial plan also considers the 4 pillars of financial planning: Protection, Debt Management, Emergency Fund, and Investment. These core pillars ensure you are well-prepared for each stage of life.

Final Thoughts

The X-Curve Concept provides a clear and visual way to understand how your financial responsibilities and wealth evolve over time. With the right financial services, you can ensure that as your responsibilities decline, your wealth continues to grow, setting you up for a comfortable and secure retirement.

Whether you’re looking for advice on retirement accounts like IRAs, 401(k)s, or SEP IRAs, or need guidance on choosing the best life insurance companies, working with a trusted financial planner can make all the difference.

Contact me today to learn more about how the X-Curve applies to your financial journey and how we can build a solid foundation for your future.